The financial profitability or even more unprofitability of energy efficiency measures has been recently an interesting topic under general discussion. The main reason behind the conversation is the reality, that CO2– emissions must be reduced in order to maintain the carrying capacity of world also in the future. However, comparing energy efficiency measures is challenging, as profitability must be described from many different perspectives:

- For one person, reducing emissions is the most important issue

- For another person, energy self-sufficiency is the most important

- For someone else costs matter the most

The way of presenting the results must be also chosen according to the target group

- For one group, the best way is presented results as numbers

- For another group, the best way is presented results as visual and clear charts.

It is also important to observe, that different development options in the future, especially changes of energy and water prices, are interesting for all stakeholders.

How should energy efficiency measures be compared?

When comparing the financial details of energy efficiency measures, the payback period is not the best way, although it is the easiest to understand.

Often 10 years is considered to be too long a payback period, although the measure may still be profitable in financial point of view.

The payback period does not take into account:

• the effect of change of energy prices

• the impact of the technical lifetime to the profitability

• the difference in the value of money now and in the future

However, these are very important factors, when shall be compared financial profitability of measures.

In addition, non-energy benefits, which are not directly related to the financial aspects, are relevant to observe: such as the improvement of the indoor climate and long-term benefits based on better air quality. For example, these measures may provide decreasing of health costs.

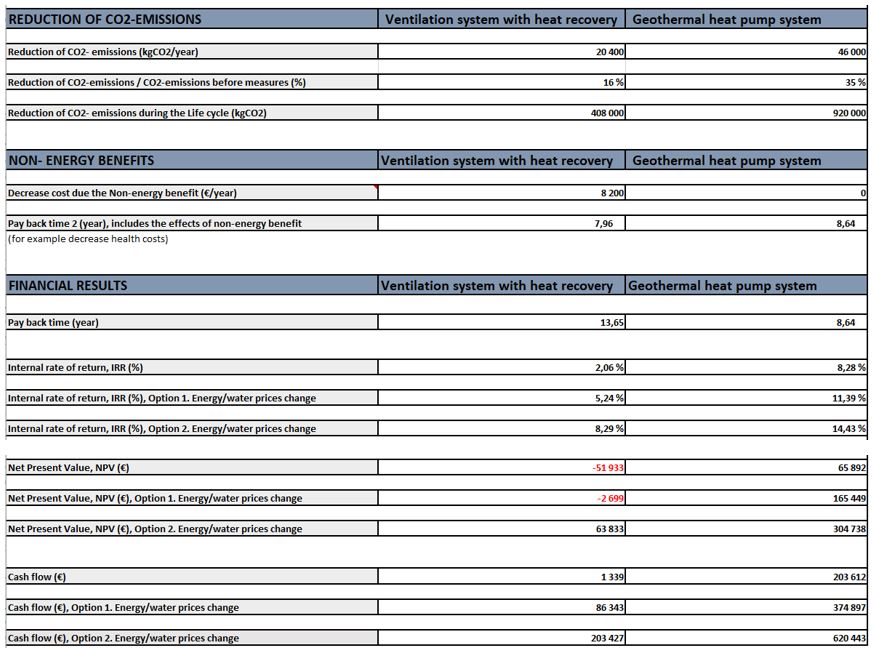

To solve the above presented problems a financial calculation tool and guideline for financial calculation methods have been developed by EFFECT4buildings -project. The tool provides a better understanding of energy efficiency investment profitability, using several calculation methods for comparing alternative energy efficiency measures:

- Payback period

- Cash flow

- Net Present Value

- Internal rate of return

- Reduction of CO2 emission

- In addition, the impact of non- energy benefits on the payback period can be estimated using a tool.

• The tool also includes sensitivity analyses with two options for estimating energy and water prices changes. This smart functionality facilitates the comparison of different development options in the future.

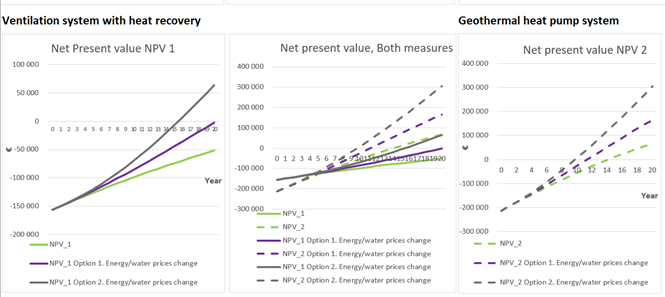

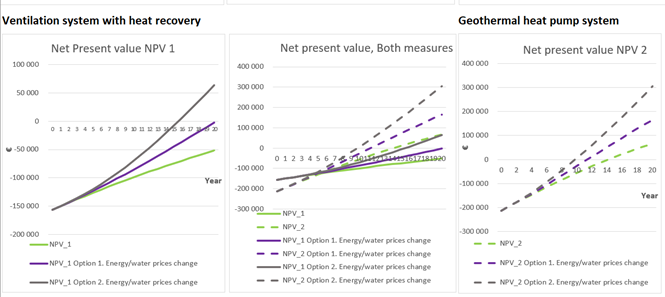

• Results are presented both numerical and graphical forms (Figures 1 and 2)

By presenting the results with many different visual options the needs of different stakeholders can be taken into account (building managers, municipalities, energy advisors, consumers, etc.).

In addition the guideline of calculation methods provides for stakeholders comprehensive instructions how to use them. Guideline can be used also as individual material for educational purposes to all possible interested parties.

The Financial calculation tool has been made as part of the E4B project (EFFECT4buildings), which goal is to increase the number of energy efficiency measures implemented in existing public buildings

• Developing financial tools themselves

• Development work (by testing tools) within the target group

• Providing training and developing guidelines for the use of tools

• Making recommendations and presenting best practices

The final result of project is a toolbox with financial methods, which can improve profitability, facilitate to find funding sources and reduce the risk of energy investment in public buildings.